Personal budgeting has become an essential skill for individuals and families across the UK, especially amid rising living costs and economic uncertainty. Whether saving for a home, preparing for retirement, or managing day-to-day expenses, having a clear understanding of income and outgoings allows people to make informed decisions and avoid financial strain.

Advertisement

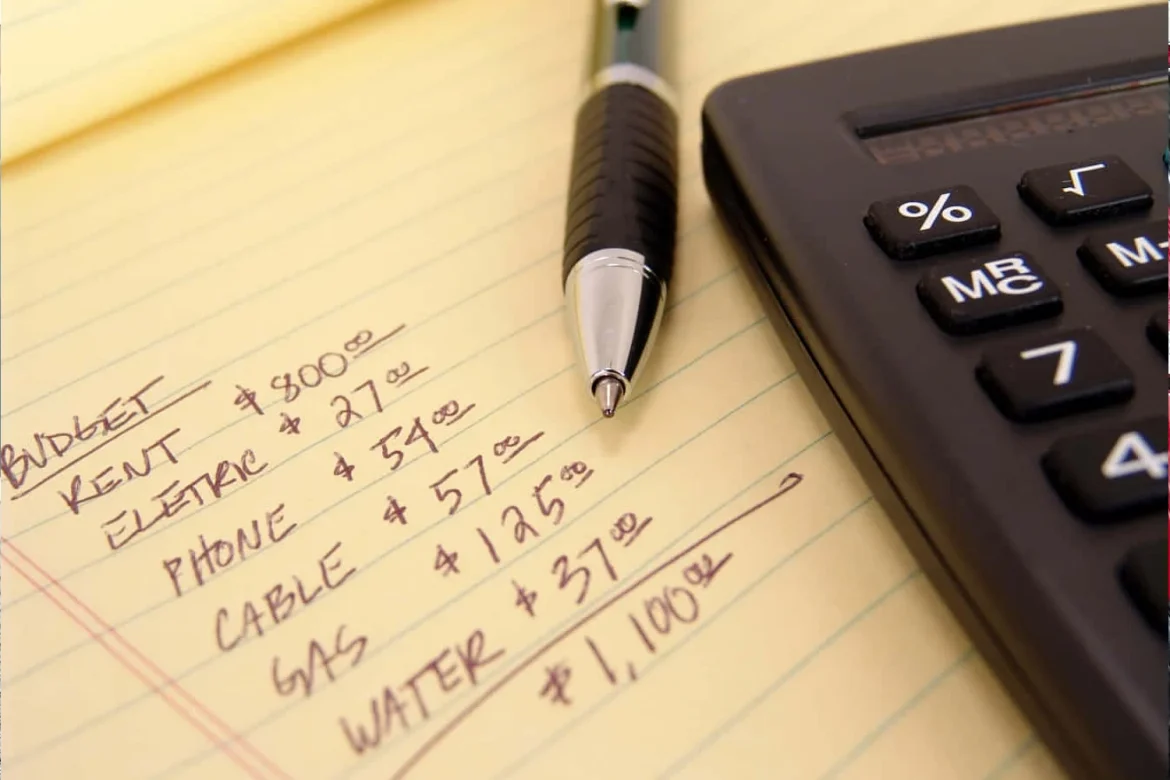

One of the first steps in building a functional budget is tracking all sources of income alongside recurring expenses such as rent or mortgage payments, utilities, transportation, and food. Many British households are turning to digital tools like budgeting apps and online spreadsheets, which simplify the process and highlight areas for adjustment. Establishing a monthly framework helps reduce reliance on credit and improves financial resilience.

Once essential expenses are identified, discretionary spending can be reviewed. Dining out, entertainment, and online shopping often represent areas where small changes lead to meaningful savings. The goal isn’t to eliminate enjoyment, but to bring awareness and intentionality to financial choices. Many UK consumers are adopting “spending fasts” or setting weekly limits to better manage variable costs.